You’ve heard the catchy phrase: “Cash is King!” And it’s true, cash is the most important thing for a small business. Unfortunately, success is extremely difficult for small businesses to achieve.

Carter (2021) wrote, “Approximately 20% of small businesses fail within the first year. By the end of the second year, 30% of businesses will have failed. By the end of the fifth year, about half will have failed. And by the end of the decade, only 30% of businesses will remain — a 70% failure rate.”

There are several reasons why a small business can fail, but we will focus on the importance cash flow plays in the success of a small business. The number one survival tip for small businesses is to protect your cash (Martin, 2002). Cash flow is king.

What is Cash Flow?

Cash flow is the cycle of cash through the business. Cash enters as revenue from sales or proceeds from a loan or cash infusion then moves to the purchase of goods or services to generate sales to continue the cash flow cycle (Thompson, 2001). A business cannot function without cash. Cash is needed for payroll, supplies, overhead, inventory, fixed and variable expenses, and to purchase raw materials or goods used to produce the company’s product or service.

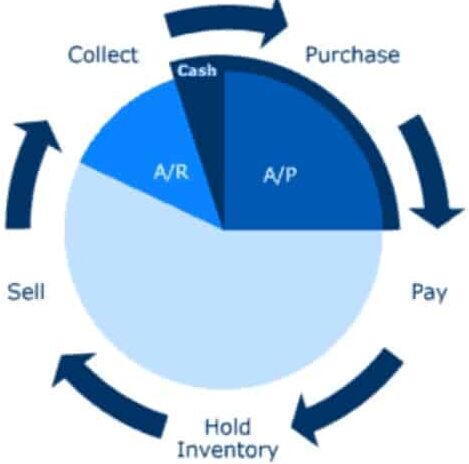

Cash Flow Process

This diagram shows the cash flow process (Worrell, 2018). The first step is purchasing to create an inventory to sell. Notice this also opens accounts payable (AP). The inventory is then held until it is sold. At this point, accounts receivable (AR) is opened. Then the cash is collected on the AR and the cycle starts over. The management of cash is what differentiates a successful business from an unsuccessful business.

Cash Flow Management

Effective cash flow management is critical to any business, regardless of size (Isle et al., 2018). Cash flow management is a critical indicator of the health of the business. A company’s success is measured by the amount of cash flow it has to cover its operations, pay debts, increase its credit rating, and maximize shareholder value (Scott, 2007).

Business operations are the most significant source of cash in and out of the business (Isle et al., 2014). Small business owners are usually operational experts in whatever field in which they operate but lack the financial literacy to manage their cash flow effectively (Isle et al., 2018). This causes a problem and contributes to the failure rate of new small businesses. To manage cash flow, the business owner needs to understand the components and measurements needed to manage the cash effectively. This requires an analysis of different business areas to obtain cash flow information.

Cash Flow Information

According to Haron et al. (2014), there are two dimensions of cash flow information. The first dimension includes cash ratio analysis, inventory, cash flow budget, bank balance, and cash flow statement. The second dimension includes accounts receivable and accounts payable. This requires the small business owner to track these aspects of the business from reports, which are pulled from their accounting software.

Once the information is pulled, it needs to be evaluated to determine necessary changes. For example, the inventory turn ratio will show how many days it takes to sell the current inventory. The sales cycle will show how many days it will take to receive the cash from a sale on credit. This information will help align the account payable with the cash receipt (Papmehl, 2018).

The business owner must know how many days of cash the company has to cover operations. A business should have 60 – 90 days of cash to cover unexpected expenses or take advantage of opportunities (Papmehl, 2018). There are several way business owners can avoid cash flow problems.

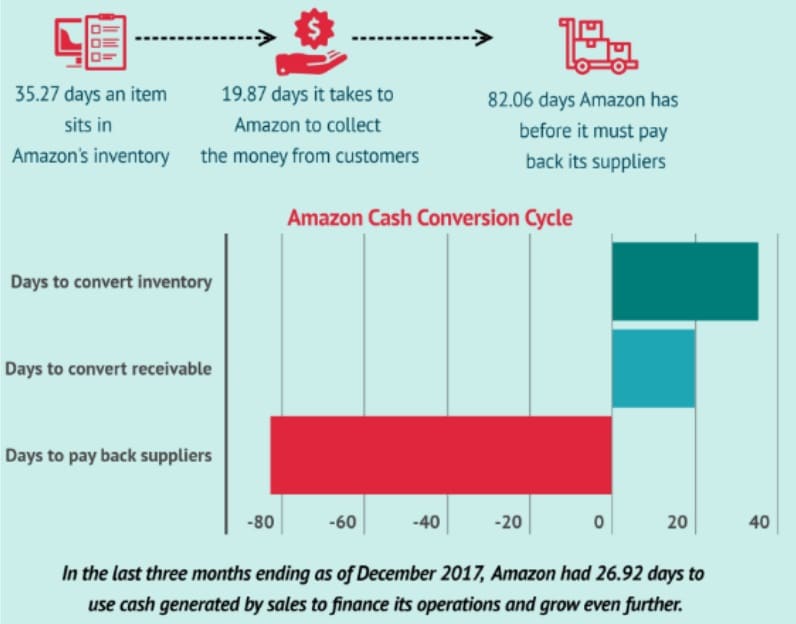

Cash Conversion Cycle – Amazon

The chart above shows the cash conversion cycle for Amazon (Cuafano, 2022). This shows how Amazon uses the cash flow cycle to its benefit and maximizes the cash to increase the business. When cash comes in, and they buy inventory, the item is sold within 36 days; they then have 82 days to pay the supplier for the inventory. That leaves them 46 days. That is enough time to order more inventory and sell it before the first order is due. For the accounts receivable, they collect their payment within 20 days. That gives Amazon 26 days to use that cash to make more money.

Most small businesses cannot negotiate terms like Amazon, but this gives an example that the cash flow cycle can benefit the company. If the components are monitored to be as short in duration as possible, cash will be received around the same time the payable is due. That will minimize the amount of cash being paid out without corresponding sales.

Solutions

One of the best ways to avoid cash flow problems is to be proactive and forecast potential issues. Consistency in billing and payable activities is key. (Sansone, 2016) This includes establishing an SOP to handle accounts receivable and accounts payable. Avoid deviating from the procedures unless necessary.

Another way to avoid cash flow problems is to set a budget and ensure strict adherence to it. Additionally, a forecasting tool will help identify potential cash flow problems so adjustments can be made early. This proactive approach will help avoid dramatic impacts on operations from last-minute decisions.

A consistent review of the cash flow management reports is also critical to avoid surprises. The most important thing when relying on financial reports is to ensure the accuracy of the data entered. A strong understanding of the financial data points that need to be entered into any accounting software is critical to accurate reporting. The saying, “garbage in, garbage out”, applies well to this scenario. You cannot expect to have accurate results when you enter inaccurate data, regardless of how good the software advertises it is. If you do not have financial literacy, seek the help of an outside entity to guide you through the process until you are comfortable. This may cost some money, but the savings will significantly exceed this through increased cash flow.

Conclusion

Cash is the lifeblood of a company. Without cash, the company dies. Small businesses are especially susceptible to failure due to a lack of cash flow control. Cash flow management will determine the overall health of the company. This is based on the results from the cash flow analysis, and reports pulled on cash flow activities. The information from the reports will help the business owner make informed decisions to prevent or avoid cash flow problems before they become too large and negatively impact operations. An effective cash flow management plan could be the difference in going under and making it past the 5th anniversary.

References

Carter, T. (2021). The actual failure rate of small businesses. Entrepreneur. Retrieved from https://www.entrepreneur.com/starting-a-business/the-true-failure-rate-of-small-businesses/361350.

Cuafano, G., (2022). Amazon’s cash conversion cycle. Four Weeks MBA. Retrieved from https://fourweekmba.com/cash-conversion-cycle-amazon/.

Haron, N., Yahya, S., & Haron, H. (2014). Cash Flow Information and Small Enterprises’ Performance. International Journal of Organizational Innovation, 7, 7–17.

Isle, M. B., Freudenberg, B., & Sarker, T. (2018). Is the literacy of small business owners important for cash flow management?: The experts’ perspective. Journal of the Australasian Tax Teachers Association, 13(1), 31–67.

Isle, M. B., & Freudenberg, B. (2015). Calm waters: GST and cash flow stability for small businesses in Australia. EJournal of Tax Research, 13(2), 492–532.

Martin, K. (2002). Survival tips for small business. Fairfield County Business Journal, 41(2), 4.

O’Brien, A. (2015). Cash flow is king. Money (Australia Edition), 183, 44.

Papmehl, A. (2018). New ways to help small business improve cash flow. Maclean’s, 131(9), 62.

Sansone, B. (2016). What to do when your cash flow dries up. GP Solo, 33(1), 28.

Scott, S. (2007). The importance of cash flow analysis for small businesses. Commercial Lending Review, 22(2), 37–48.

Thompson, M. (2001). Cash flow management and the small business. Enterprise/Salt Lake City, 31(21), 13.

Worrell, D. (2018). Optimizing cash flow: The cash flow cycle explained. Fuse CFO. Retrieved from https://fusecfo.com/blog/blog-optimizing-cash-flow-for-small-business-the-cash-flow-cycle-explained/.