One of the most common, yet critical, mistakes that small business owners make is to blur the boundaries between three related but dramatically different decision-making forums.

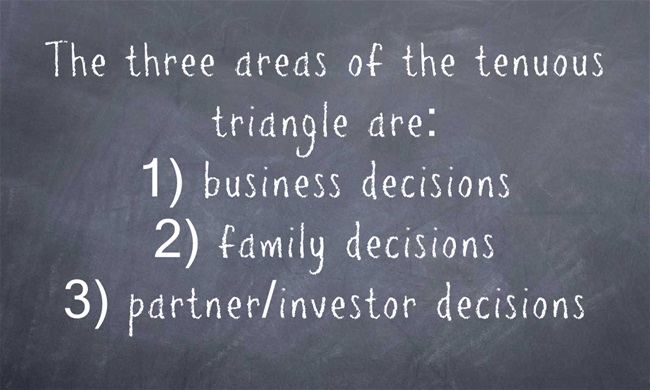

One key to long-term success is to keep the three legs of these decision areas – the “tenuous triangle” – separate from each other.

Unfortunately, too many small businesses experience problems when owners/founders make serious and long-term decisions without the involvement and input of the appropriate stakeholders.

Business decisions should be made only with the firm’s senior leadership team, which is typically made up of key functional managers with line responsibility and accountability for the performance of their respective departments. These managers may or may not include family members. The decisions made in this forum deal with the interests of the business as a going concern. Typical issues dealt with in this forum have to do with strategic plans (firm expansion and associated hiring plans), growing or scaling back product lines, whether to make an investment in new plant and equipment and when to roll out new products or services, etc. These decisions are primarily STRATEGIC and OPERATIONAL in nature.

Family decisions should be made with all family members who are related to the founder/owner and who have a long-term financial interest in the fate of the business. In this forum, discussions usually involve legacy issues and ownership rights and determining future claims to the profits as heirs if the founder passes away, or if he/she sells the business or turns it over to one or more of his or her children. As such, family decisions typically revolve around ESTATE PLANNING matters.

Lastly, partner/investor decisions should be made with outside partners and investors, which in the majority of cases are usually bankers, passive investors, and/or outside (non-family) partners with minority interests in the business. In this forum, the decisions have to do with repayment of loans or debt, the buyout of partners, and dividing up claims to a percentage of the company’s profit streams. The decisions can also deal with a future investment of capital to cover operating or budget shortfalls, etc. As a result, decisions in this forum are overwhelmingly FINANCIAL in nature.

Problems occur when owners/founders fail to separate each of these decisions into the appropriate forum. Operational decisions are too often made when sitting at the dinner table surrounded by family members, or strategic decisions are made on the golf course with a business partner.

When these kinds of boundary-crossing behaviors take place, problems typically occur. Any decisions that are made are usually sub-optimal because the right stakeholders are not part of the discussion. While it is easy to say but hard to do, small business owners/founders need to remain disciplined and confine discussions only to the appropriate forum and resist the temptation to make decisions “on the fly” or at the proverbial kitchen table.

At Cogent Analytics, we are always looking for ways to improve your business and so should you. Don’t miss these other posts that could help you in your business: