As a business owner, you are used to thinking ahead concerning your business strategy and taking care of finances. But do you take enough care of your personal strategy and finance? Many business owners are so involved in their business that they forget about their private future. As a business owner, a business might go bankrupt, and you do not have the same safety net for retirement planning as an employee.

Start to build your private financial future early.

“A journey of a thousand miles must begin with a single step.” Lao Tzu, ancient Chinese philosopher

You should start to think about your retirement now! An analysis shows:

- When you start at age 15, you need to save 8% of annual income for life at age 30.

- You need to save 21.4%, at age 40.

- You need to save 43.2%.

| Age of Starting to Save: | 15 | 20 | 25 | 30 | 35 | 40 |

| % of Annual Income: | 8% | 11.1% | 15.4% | 21.4% | 30.1% | 43.2% |

If you look at your personal finances, there should be a certain degree of saving that you should have.

Compound interest rate and dividend growth compounding work in your favor

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t… pays it.” Albert Einstein

The compound interest rate describes the interest on the interest. Reinvesting profits leads to an exponential return on your investment. There is an interesting story to explain what the compound interest is: An Indian man invented the chess game in the 3rd century. The king of that time was impressed. He asked him how he could pay the inventor for his great idea. The inventor said that he wanted a single rice corn on the first field of the chess game, and it should be doubled for every field. The king thought how much of a modest man the inventor was. However, the king did not realize that for 64 fields, a total of 18.4 quintillions (10^18) rice corns must be paid. This is more rice than available during that time on the entire earth.

Take risks – but do not take uncalculated risks.

“Risk comes from not knowing what you are doing.” Warren Buffett

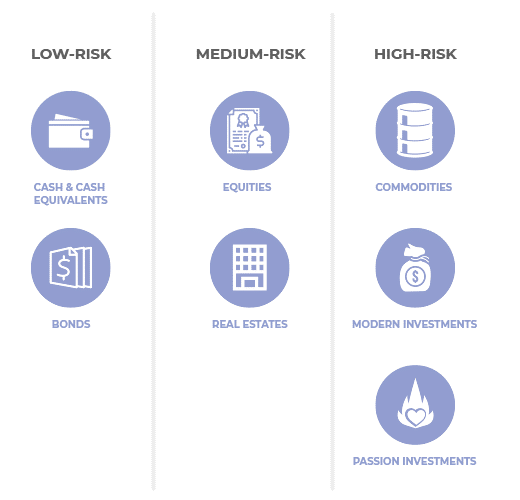

The different asset classes are associated with different risks. Within an asset class, risks can vary a lot; however, each asset class itself carries a particular risk that is being categorized by institutional and private investors. Cash, Cash equivalents, and bonds are generally considered low-risk assets. Equities (mostly stocks) and real estate are considered medium-risk assets; meanwhile commodities, modern investments (e.g., bitcoin), and passion investments (e.g., art) are considered high-risk investments.

As there is no asset class without risk, a strategic asset allocation mix helps you to distribute the risk among different investments while still being profitable.

You do not need a financial consultant to invest

“If you’re so smart, why aren’t you rich?” Introduction of The Riddler in Batman

Whenever you take financial advice from a professional, you will pay for it one way or the other. Bank consultants are trained to sell you overpriced products, e.g. you charging additional 5% to buy a fund or a high annual fee. Independent financial advisors will charge you on your profits without taking responsibility for your losses or they will charge you a flat fee which reduces their interest in you making a good profit. Depending on your level of motivation to invest on your own, a financial consultant might be helpful. But always keep in mind: If you really want you do not need a financial consultant and if you need one, be sure he will charge you. There are so many people working in the financial industry which promise you great profits. However, most of them are not specifically rich. It is scientifically proven that most professional investors do not achieve higher returns than any individual investor. Probably you are your best advisor!

Become an investor – not a speculator or trader!

“The individual investor should act consistently as an investor and not as a speculator.” Benjamin Graham, the grandmaster of Warren Buffet

Investing is fundamentally different from speculation and trading. Investing means putting money to increase personal wealth over an extended period of time with a balanced risk. Investing is based on facts and conditions that allow you to be as much in control as possible with the smallest risk possible. While investing, you should reduce costs as much as possible. This leads to buy and hold strategies. Reinvesting profits and using tax optimized approaches to maximize profits and reduce risks is part of investing for your personal retirement. Speculation and trading, in contrast, are short-term approaches with a high risk that the average investor ends up with negative returns.

Markets must grow with time

“The overall point is that new technology will not necessarily replace old technology, but it will date it. By definition. Eventually, it will replace it. But it’s like people who had black-and-white TVs when color came out. They eventually decided whether or not the new technology was worth the investment.” Steve Jobs

Markets grow in the long-term. On the one hand, there is inflation. On the other hand, the population in the world is growing and technology is progressing. Along with the global population, average wealth is increasing as well. This means that there will be a constant growth in the long term. According to projections of the United Nation, the global population will be 9.8 billion in 2050 and 11.2 billion in 2100.

Technological development is faster than ever. The Time artificial intelligence will reach human intelligence by 2023 and the intelligence of all people in the world by 2045. Be part of this development!

Conclusion: Constant investment is important! ETFs are a possibility to invest with low cost and low risk

“The best way in my view is to just buy a low-cost index fund and keep buying it regularly over time because you’ll be buying into a wonderful industry, which in effect is all of the American industry…People ought to sit back and relax and keep accumulating over time” Warren Buffett

The asset allocation determines the risk and return of your investments. Low-risk investments such as bonds currently offer small returns only. High-risk investments are an expert-only area. This leaves you with few alternatives: equities and real estate. Real estate offers good investment possibilities but also means additional work. Equities, mostly stocks, must be diversified. You can purchase single stocks, funds or ETFs. ETFs have recently become widely popular as they allow you to diversify your investments in the same manner as with a fund at a price a little higher than what you pay for stocks. Therefore, ETFs are an easy choice with diversification included. Other asset classes can be added if you feel comfortable, e.g. passion investments in art, whiskey, wine or classic cars – but only if you have the knowledge. Bonds on the other hand can be a safe investment with guaranteed (low) returns as a counterpart for more risky investments. However, ETFs offer a great basis for your investment strategy. If you want to learn more about investing and build your own investing strategy, check out investmentcanvas.com.

About the Author

Jan-Patrick Cap, MBA, Ph.D., is a mechanical engineer working in top strategy consultancy. In his doctoral studies, he focused on innovation and network management. He worked in Europe, the USA, Brazil, China, and UAE. His passion is finance and entrepreneurship. Jan-Patrick is the co-founder of investmentcanvas.com, a website that offers a free academy and tool to learn to invest with a long-term perspective.

Disclaimer: All content provided is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Reliance on this content for the purpose of engaging in any investment activity may expose an individual to a significant risk of losing all of the property or other assets invested. Any person who is in doubt about the investment to which this document relates should consult an authorized person specializing in advising on investments. The author is affiliated with investmentcanvas.com.