In the world of marketing effectiveness, understanding the long-term impact of your efforts is crucial. For small businesses, especially those that offer a subscription service or rely heavily on repeat business, this becomes even more significant.

In this article, we’ll explore how calculating Lifetime Revenue and Customer Acquisition Cost (CAC) plays a pivotal role in determining the Return on Investment (ROI), using a SaaS vendor as our case study.

The SaaS Landscape

Imagine a SaaS vendor offering project management software to businesses. They operate on a subscription model, generating revenue through monthly or annual subscriptions. Additionally, they provide training sessions for an additional fee, contributing to their overall revenue stream.

Customer Acquisition Cost (CAC)

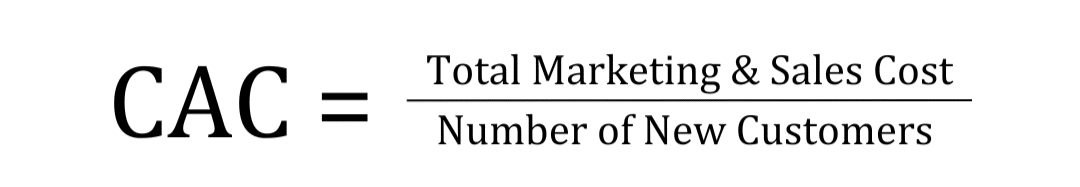

The first step in this strategic approach is to delve into the Customer Acquisition Cost. CAC is the cost associated with acquiring a new customer and is a critical metric for subscription-based businesses. For our SaaS vendor, the CAC includes marketing and advertising expenses, sales team costs, and any other expenditures directly related to acquiring new customers.

Let’s break down the CAC formula:

For our SaaS vendor, if they spent $10,000 on marketing and sales efforts and acquired 50 new customers, the CAC would be $200.

Lifetime Revenue

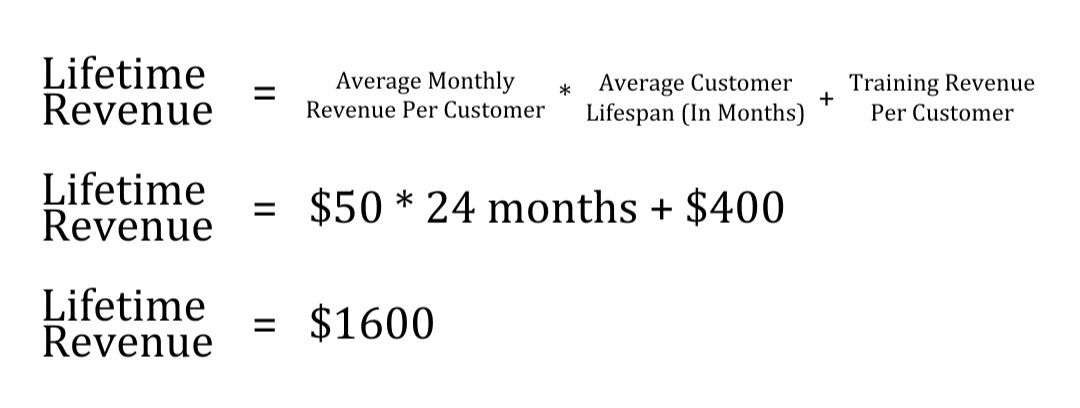

Now, let’s shift our focus to Lifetime Revenue. This metric involves calculating the total revenue a customer is expected to generate over their entire lifespan as a paying subscriber. In the case of our SaaS vendor, it includes not just the subscription fees but also revenue from additional services like training.

The Lifetime Revenue formula is as follows:

If the SaaS vendor charges $50 per month per subscriber and the average customer stays subscribed for 24 months, the Lifetime Revenue would be $1200.

Calculating ROI

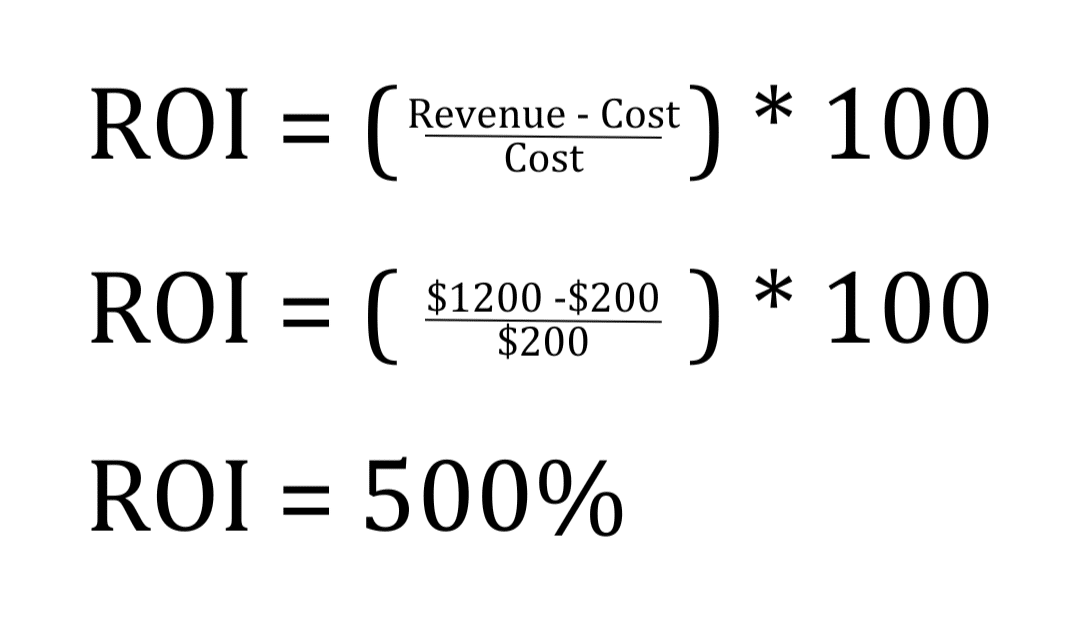

With both CAC and Lifetime Revenue in hand, we can now calculate the Return on Investment. The modified ROI equation for this approach is:

In this scenario, the ROI is approximately 500%, indicating a solid return on investment. This means that for every dollar spent on the marketing campaign, the contractor gained about $5 in return.

Determining ROI Strength

So, what constitutes a good ROI in marketing? A general guideline suggests a range of 400% to 600%, with anything below 200% considered poor and results exceeding 1000% deemed exceptional. This range depends on the profit margins of the business. High-profit margin businesses can afford lower ROI campaigns, while those with narrower margins need higher returns for the effort to be worthwhile.

In our example, 500% would be a successful marketing campaign. If feasible and if we have the capacity to support more sales, we should invest more money in the marketing campaign to expand it and capture more revenue.

Additional Revenue Sources

Firms should measure all revenue sources when calculating lifetime revenue. Training and service contracts are common sources of additional revenue that should be added into the lifetime revenue formula.

For our SaaS vendor, offering training sessions provides an additional revenue stream. Let’s say they charge $2000 for each training session, and on average, 20% of their customers opt for training. This adds an extra layer to the Lifetime Revenue calculation:

Training Revenue per Customer = $2000 × 0.2

This means an additional $400 per customer for training.

Now, the updated Lifetime Revenue formula becomes:

With this inclusion, the Lifetime Revenue increases, positively impacting the ROI.

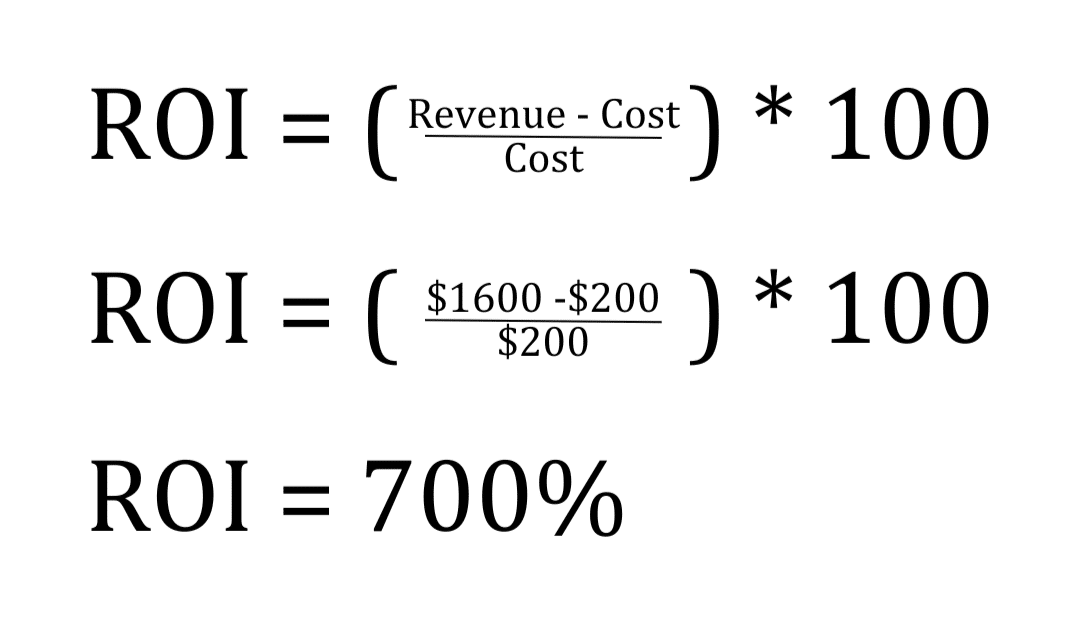

Our new ROI when including the additional revenue source is 700% which is an exceptional marketing campaign.

Conclusion: A Holistic Approach to ROI

In the ever-evolving landscape of subscription-based businesses, a holistic approach to calculating ROI is crucial. By considering both Lifetime Revenue and Customer Acquisition Cost, businesses gain a more comprehensive understanding of the impact of their marketing efforts.

For our SaaS vendor, offering additional services like training further enhances their revenue potential and contributes significantly to the overall ROI. This strategic approach enables businesses to make informed decisions about their marketing strategies, ensuring that the cost of acquiring customers aligns with the long-term value these customers bring.

In the final part of this series, we’ll explore the intricate world of branding and how it factors into the measurement of marketing effectiveness for small businesses.