It’s imperative that business leaders understand the difference between Gross Profit, Gross Margin, and Markup as well as how they can affect the company. Often-times these terms are used interchangeably due to the misconception that they are one in the same. Knowing and understanding the difference prevents making decisions based on misleading information that can have a negative impact the bottom line and business!

Profitability, Income, Markup, Gross Margin, Gross Profit

Gross Profit, Gross Margin, Markup: How do they differ?

Gross profit is the total profit dollars. That is, it is simply the difference between the net sales and cost of goods sold(COGS). Markup and Gross Margin, on the other hand, is the percentage of profit; one based on cost and the other based on selling price.

Markup is the percentage of profit based on the cost. To determine the Markup, subtract COGS from net sales then divide by COGS. For example, $100 – $80/$80 = 25%. If you want to establish the Selling Price based on Markup multiply the cost times the desired Markup (%) and add the cost. Using the same example $80 x 25% + $80 = $100

Gross Margin is the percentage of profit margin based on selling price, which yields a much different result than Markup. Calculating Gross Margin is the same as Markup except you divide the Gross Profit by the Selling Price. Using the above example, the Gross Margin is $100 – $80/$100 = 20%. Using Gross Margin, the Selling Price can be established by dividing the cost by the inverse of the desired margin or (1 – 0.2)/1 = 0.8. Using the same example $80/0.8 = $100.

What is the Impact to the Bottom Line?

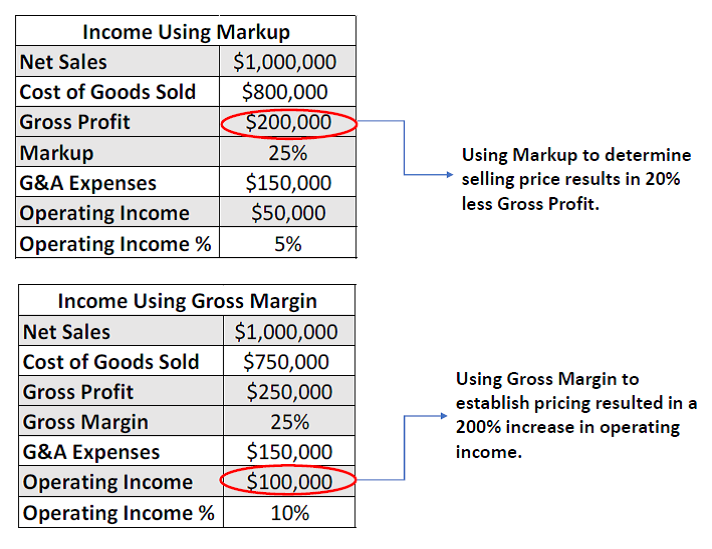

In reviewing the pricing examples above, Gross Margin is five percentage points below Markup. If you use Markup instead of Margin, this shortfall goes straight to the bottom line because all the other ratios for product cost (labor and overhead), G&A expenses and operating income are based on sales. Establishing pricing using Markup instead of Gross Margin has far-reaching effects. This is further evidenced in Figure 1 below comparing operating income at 25% Markup versus 25% Gross Margin on net sales of $1,000,000. In this example, using Markup results in 20% less Gross Profit and Operating Income is reduced by 50% dropping from 10% to 5%. It should also be noted that the higher the margins, the greater the spread in overall profitability.

Protect your bottom line. Always use gross margin to determine your selling prices!

At Cogent Analytics, we never stop looking for ways to improve your business and neither should you. So, check out some of our other posts for helpful business information: