Understanding how to calculate cash flow is of high value to an SMB/E.

Operating cash flow Formula for an SMB/E provides a measure of the amount of cash generated by a company’s normal business operations.

The output from the Operating cash flow formula will indicate whether a company can generate enough positive cash flow to maintain and grow its operations. Otherwise, it may require external financing for capital expansion.

It is essential to avoid confusion when talking about the Operating Cash Flow Formula; cash flow metrics need to be clear and useful.

This includes the net margin after, e.g., cost of goods sold and operational expenses have been taken out.

It does not typically include non-operational fund additions such as capital grants, loans, interests from investments and such.

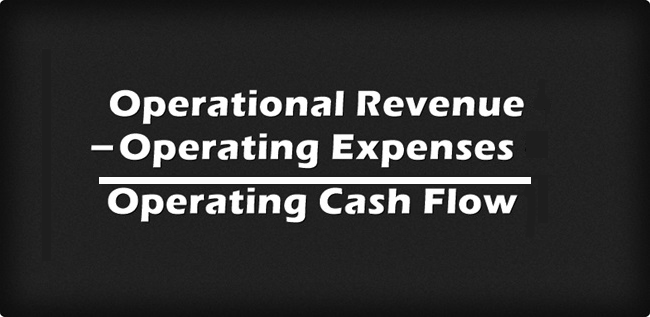

Formula:

Generally, the Operating cash flow formula is calculated in two different ways. The first way, or the direct method, subtracts operating expenses from total revenues.

This calculation is accurate and straightforward but does not give investors much information about the company, its operations, or the sources of cash. That’s why GAAP (Generally Accepted Accounting Principles, your accountant knows more about this) requires businesses to use the indirect method of discovering the cash flows from operations. This method is an indirect, roundabout, way to calculate it.

The operating cash flow equation for the indirect method adjusts net income for changes in all non-cash accounts on the balance sheet. Depreciation and amortization are added back to net income while it is adjusted for changes in accounts receivable and inventory.

Net Income +/- Changes in Assets & Liabilities + Non-Cash Expenses = Operating Cash Flow

Changes in assets and liabilities are, e.g., accounts payables and receivables. Non-cash expenses are, e.g., credits due to poor quality.

This Operating Cash Flow formula version is a bit more complicated but gives much more information about the SMB/E’s operations for banks and SMB/E lending associations.

Knowing how to calculate cash flow allows you to present the operating section of the accrual income statement to a cash basis statement.

At Cogent Analytics, we never stop looking for ways to improve your business and neither should you. So, check out some of our other posts for helpful business information: