On numerous occasions, I have asked plumbing, coating and finishing, HVAC, or glass company owners and executives, “What is it you sell?” I get a variety of answers like excellent service, best prices, superior products, experienced techs, or quality installation. “No!”, I jump up and say. “You sell labor! Your clients come to you for your expertise, so in return, you sell them labor hours to perform the needed service they require.”

Now I would be foolish to tell you these other items mentioned aren’t important like excellent service and superior products, but you could excel in these areas, still lose money, and eventually become insolvent and unfortunately cease to exist. The actual challenge in business is how you manage your costs, increasing the probability of profitability and ultimate success. Labor costs will be our focus.

Consistently “sculpting” profit ultimately determines success in everything you do. You do NOT do this by applying antiquated or “other company’s” metrics into YOUR pricing formula. Nor can you determine your price by “what the market will bear.” You accomplish success by determining your unique company metrics and utilizing break-even principles to decide what you will charge your clients and be profitable.

Using this process is not as difficult as it seems if you make the following seven simple calculations to create a valid global bidding format for your company:

From your last full year’s Profit and Loss statement, extract the following and list on a sheet of paper (or Excel spreadsheet):

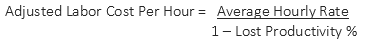

- Total direct labor cost – direct labor consists of anyone that works for you and you make money off by billing hourly. Bookkeepers, warehouse personnel and non-billing managers do not qualify. You may need to get this from your payroll report if direct labor is not listed separately on the P & L by your accountant. Total the amount. (Deduct any vacation and holiday pay calculated as per NOTE below)Additionally, it is inconceivable to expect 100% of your billable hours to be billed thus negatively affecting your labor productivity. We have vehicle cleaning, inventory loading, answering client questions, safety meetings, and a whole host of other activities that take us away from our primary concern—billing hours. Therefore, it is prudent to adjust our available billable hours and absorb the unproductive hourly costs into the hours billed. The formula is as follows:

For this example, we are assuming lost productivity at 15%:

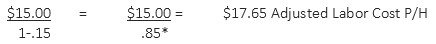

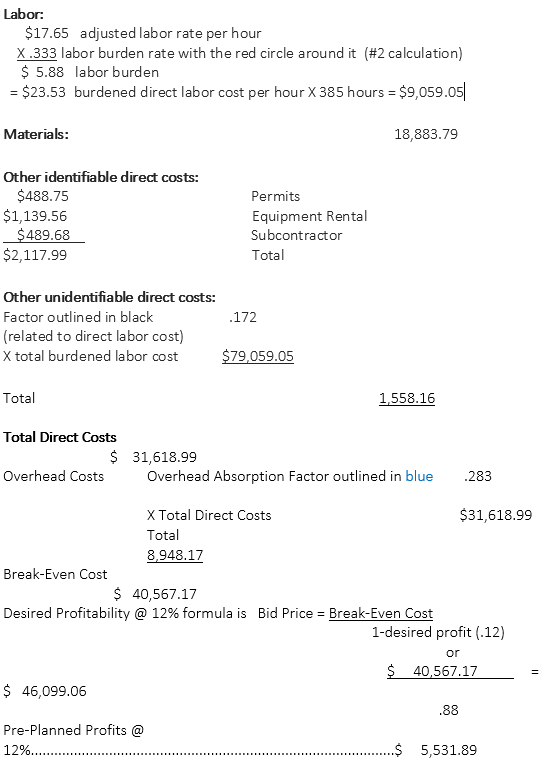

*This is known as your labor productivity rate and 85% is an acceptable approximation to be utilized if you do not know the exact number. However, if you know your labor productivity rate, use that number instead to reflect your real situation. - Total direct labor taxes and expenses – FICA, FUTA, SUTA, Workers Comp, Medicare, uniforms, vacation pay, holiday pay, healthcare, and any other benefit you may offer. These are examples of “Labor Burden.” Total the amount and divide by the total direct labor amount. It will come out as a decimal and look something like this: .333 or 33.3%. Now you have your labor burden rate. Circle this in red. We will incorporate in the following segment.(NOTE: Any holiday and vacation pay calculations must be deducted from the Total direct labor calculations above to reflect specific, billable labor hours available.)

- Total direct materials costs – or commonly referred to as COGS. These are materials or products used in the service or installation process.

- Other identifiable direct costs – items that you identify and place into a bid calculation such as permits, hotels and per diem costs, subcontractors, and equipment rental. Total this amount.

- Other direct costs that are not identifiable – items you cannot calculate per job and add to the bid but still used and must be accounted for and incorporated into the costing process. Examples of these costs are miscellaneous material costs (nails, welding solder, etc.), credit card fees, etc. Total the amount and divide by total direct burdened labor amount (direct labor plus direct labor burden). It will come out as a decimal and look something like this again: .172 or 17.2%. Circle this in black. We will apply this Other Direct Cost Factor to every job. In other words, for every dollar we spend on labor, we also devote 17.2c (or 17.2%) on Other direct costs that are not identifiable. We will apply this concept in the following segment.

- Tally up all of your Direct Costs (items 1 through 5) – this is important for future overhead and break-even calculations.

- Tally up Overhead Costs – these are all the remaining costs (or commonly referred to as fixed costs) from the Profit and Loss statement. Total the amount. To make sure you have calculated everything correctly add the Overhead Costs to Total Direct Costs. Take this sum and subtract it from your revenue from the P & L and you should have the same operating profit as the P & L. If not then one of your calculations is incorrect. It will probably be the Overhead Costs that is incorrect. Recheck your direct cost calculations. If correct then adjust your total Overhead Costs. Once completed, divide your Overhead Costs by Total Direct Costs. The result will come out as a decimal or percentage .283 or 28.3%. Circle in blue. This Overhead Absorption Factor will be used later in the costing process.

We are ready to utilize the metrics just created in constructing a break-even format for your bidding. Here’s the scenario. You just obtained information on client requirements for a bid, conducted a take-off and came back with the following information:

It is estimated to take 385 labor hours to complete the project.

We estimate a total of $18,883.79 in materials will be required to meet the client’s needs. ($15,000 in primary purchases and $3,883.79 in support and construction materials)

Permits for this project will cost $488.75

We must rent a piece of equipment for one week during the initial phase costing $1,139.56.

We must bring in a subcontractor for critical quality control reasons before the final inspection for two days at the cost of $489.68.

How do we proceed and how much should you make? It is always good to have a profit percentage as a goal each year to direct your activities. This is key to ensuring you end up with the desired rate at the end of each month/quarter/year. We have selected, for this exercise, 12% as the goal.

This whole model is based upon meeting the projections primarily for labor and materials. Any overruns in time from mismanagement or replacement of materials from rework or miscalculations come out of “pre-planned” or sculpted profits. This holds true for any other costs running over budget and necessitates the importance of monitoring and controlling your direct costs.

At Cogent Analytics, we never stop looking for ways to improve your business and neither should you. So, check out some of our other posts for helpful business information: