What is strategic planning?

Let’s start with the most basic. Strategic planning is the process in which a business defines and executes a long-term plan to achieve organizational objectives through analysis of present and the desired future state, the company’s environment, and its existing gaps. This planning is done to respond to internal and external changes, so that the company remains competitive in the market. It not only consists of setting specific objectives but establishing the actions and steps to accomplish those objectives. In essence, it is a fundamental tool for making internal decisions in any organization.

How to build a strategic plan?

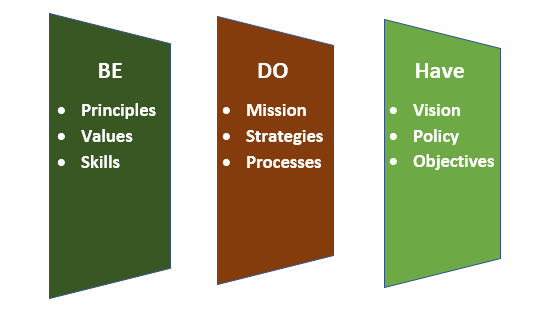

If there is an image that illustrates the concept, it is this:

Let’s understand the illustration with a personal example:

If I want to have a large income, it is necessary to be specific on how much I want to have. Based on this number, I must carry out a strategy and activities that allow me to have that specific amount. But nothing will surely be carried out if I am not suitable and prepared to carry out this strategy. It is necessary that I have a series of principles, values and skills that allow me to DO in order to HAVE. For a business, it is exactly the same. Thus, in order to build a strategic plan, we will approach a series of stages framed within the cycle of “Be-Do-Have” of a company.

There are many examples of companies that have followed and executed strategies that were purposely and strategically designed within this cycle with tremendous success. I want to share three multinational companies as the best examples.

Toyota

Humility as a business strategy1

In 1973, the ‘Big Three’ automakers in the US had more than 82% of the market share. By 2016 they have less than 50%. The main reason for this was the aggressive (and unexpected) entry into the US market by Japanese automakers, led by Toyota in the 1970’s.

Cars are big, heavy, and expensive to move. That’s one of the reasons the American market was so shocked when Toyota started selling Japanese-made vehicles in the United States, and at prices much lower than they could match. The auto industry was a massive contribution to the US economy, so one of the government’s first reactions was implementing protectionist taxes on all auto imports, making Japanese cars as expensive as locally made cars.

But the tactic failed. Within a few years, Toyota had managed to establish production plants on American soil, thus eliminating the need to pay any of the new import taxes. At first, American automakers weren’t so concerned. They assumed by having to move production to the US, production costs for Japanese automakers would surely rise to the level of the local auto manufacturers. But that did not happen. Toyota continued to produce cars (now made locally on American soil) at prices significantly cheaper than American companies.

Their extremely polished production process was so efficient and lean that they could beat American automakers at their own game. You’ve probably heard of the notion of “continuous improvement.” In the manufacturing world, Toyota is practically “the grandfather” of precisely this and its strategy has been managed by utilizing the Balanced Scorecard.

Toyota’s strategy consists of two aspects: studying the competition, continually improving their weaknesses, and being humble. Toyota spent years studying the production lines of American automakers like Ford. They knew that the American auto industry was more advanced and more efficient than the Japanese. So, they studied their competitors and tried to copy what the Americans did so well. They combined these processes with their own strengths and came up with something even better. They continuously thrived in the BE-DO-HAVE cycle.

Toyota proved that knowing your own weaknesses can be the key to success and one of the best business strategies you can implement.

Can you name a single famous executive at Toyota? It is very difficult, and one reason is that Toyota’s number one corporate value is humility. Not even the top floor executives have named their own car spaces. The humility that helped them break out of the United States market is deeply ingrained in the organization, from top management to their workers, and of course embodied in its strategic planning.

Tesla

The long game…

The conventional business logic is that when you start something new, you create a ‘Minimum Viable Product’ or MVP. Basically, that means that you create a version of your product that is very lightweight in terms of functionality and “gets the job done.” It also means that the first version of your product should generally be sold at a low starting price, both to make up for its lack of features and to generate interest in a new release.

Some organizations (including many tech startups) take this concept even further and release the first version of their product completely free, with a plan to “monetize” later once they have added more features and the product goes through more rigorous testing where the company feels more comfortable that the consumer to be willing to pay for the offering. Tesla, on the other hand, did things ultimately the other way around. They clearly defined their long-term goal and the path that would lead them to achieve it. Its long-term goal is to be the largest automobile company in the world. They know that to become the biggest by volume, they will have to thrive in the low-end consumer car space, meaning the cars that cost less than $30,000 to consumers.

However, instead of starting with this market, and creating a cheap, low-profile version of its electric car to reach scale quickly (and thus benefiting from economies of scale in addition to meeting its growth targets), Tesla created the absolute most luxurious and expensive, a sports car with all the features they could muster. That car was the Tesla Roadster, and the latest generation Roadster retails for more than $ 200,000 for the base model. This was the first car they ever produced, knowing that they couldn’t achieve the scale or efficiency necessary to make a profit (even at such a high price). Well, Tesla recently defeated General Motors to become the most valuable automotive company in the world.

The first thing to keep in mind is that Tesla has made incredible progress toward its goal of making mass-produced, affordable electric cars. They have even made annual profits last year for the first time in their history. The second thing to keep in mind is that much of Tesla’s business strategy was strained. There was no way they could have created a profitable electric car for the mass market without economies of scale.

At the end, Tesla’s supply chain strategy is one of the most brilliant moves they have ever made. They knew from the beginning that batteries present not only the biggest technological hurdle for their car, but also the biggest bottleneck to production. However, instead of letting this stop them, they took full control of their supply chain by investing in factories that make batteries. This has had the added benefit of allowing them to use those same batteries in parallel commercial ventures like their Powerwall.

PayPal

Dare to challenge the status quo1

There are specific industries that you just don’t want to mess with. Industries such as aeronautics, large groceries and supermarket chains, and banking. Frankly, banking is probably the most challenging industry of all because the substantial entry barriers. You need a large capital, go through a ton of regulatory approval, and it takes years to build trust with customers around their most important asset – their money. Banks’ business models haven’t significantly changed in hundreds of years, and they make huge amounts of profit, without really modifying a single thing on their strategy. They are incredibly powerful and almost impossible to displace. But for some “stubborn” reason, PayPal didn’t seem to care. Currently, it is the leader in online payments. It is likely that when deciding to enter this highly competitive industry, what they had in mind was the creation of a blue ocean. Blue Ocean strategy means creating and capturing uncontested market space by pursuing differentiation while simultaneously creating new demand, where there is no competition. PayPal strategy was based partnerships and a marketing campaign.

The first thing that PayPal did was to massify its use through an aggressive marketing campaign that consisted of offering first $ 10 and then $ 5 for registering in the system, which caused growth between 7% and 10%3. Consequently, they became the preferred payment provider for transactions on Ebay which led to Ebay acquiring them.

The second strategy was making partnerships. Banks had always been cautious about forming partnerships directly with retailers; instead, they relied on their scheme partners (Visa / MasterCard) to do it for them. They didn’t want the hassle of managing so many different relationships, and they were extremely confident in the fact that credit and debit cards would always be at the heart of the financial payments system. But the problem was that MasterCard was already working on a partnership with PayPal. Leaving banks out of the action. Before the COVID pandemic, PayPal proudly held an incredible 20%2 market share of online payments in the US, and 62.7%3 of the eWallet space. Most of that growth comes from its direct relationships with merchants large and small.

PayPal lived in the BE-DO-HAVE and even used the Growth-Share Matrix (BCG) to develop its strategy. This matrix was created in 1968 by Boston Consulting Group’s founder Bruce Henderson, it has been used by almost half of the Fortune 500 companies; this gave PayPal the ability to build their plan by defining their strategic advantages while continuously differentiating themselves from the competition:

- PayPal spends less on technology than an average midsize bank; nevertheless, their platform is far superior.4Consumer trust in PayPal is equal or greater than a brick-and-mortar bank, even though they have existed for a fraction of the time.

- Consumer purchases via PayPal are not shared with the banks. They simply appear on the bank/card statement as “PayPal”, this gives PayPal the ability to mine data and monetize the relationships between consumers, retailers, and service providers.

- PayPal is faster, more agile, and almost always first-to-market on any new payment innovation.

- PayPal refuses to associate itself directly with banks; instead, they have chosen to build partnerships and alliances with retailers and consumer service providers.

Strategic Planning is fundamental to the success of any organization. However, not only is its development important, but continuous follow up and execution of action items just as crucial, because from the results of these actions that changes can really be established, and decisions that influence behavior be made. There is no difference on the size of the company or organization, the fundamental steps to creating and executing a Strategic Plan remain the same, the commitment to its importance, execution and understanding of the cycle will define the longevity and success of a business.

- Corporate Strategy – Ulrich Pidum 2019

- Statista.com- 2021

- Spendmenot.com – 2020 Statistics on payment platforms vs banks

- The Economist: “Banks vs big tech” May 8th, 2021