When you start a company, one of the first things you must do is to determine how to define your fiscal year for financial reporting. There are several ways in which a company can define a fiscal year, and, the two most popular are the Calendar Month and the 13 Period Calendar.

Both methodologies have their good points and drawbacks to consider, so you may want to spend some time making the final decision. The Calendar month method is straightforward to use for fixed expenses, which allocates 8.33% of the full year amount in each month. Expense items in this category would be Amortization, Depreciation, Monthly Dues and Subscriptions, Annual Insurance Premiums, Licenses and Permits, Rent and/or Lease Expense, even recurring revenue from a customer to name a few. The variable revenue and expenses would be recorded in the month that the sale or cost is incurred. The 13 Period Calendar is slightly more complicated because you have 13 four-week periods in normal years which is 7.69% of the full year amount to be allocated over the 13 periods. The variable revenue and expenses would be recorded in the period in which the sale or cost is incurred.

Because the 13 Period Calendar is only 364 days long, every 5 or 6 years, depending on the number of leap years, there has to be a 53rd week added onto the last week of December for your fiscal year. The variable revenue and expense would still be recorded through the 35th day or end of the 13th period. These amounts would usually be more than the other 12 periods because the 13th period is 25% higher than the other 12 periods. On a weekly basis, the fixed revenue and expense would be less than the other 12 periods because you would be allocating four weeks of fixed, variable and expense items over five weeks instead of four weeks.

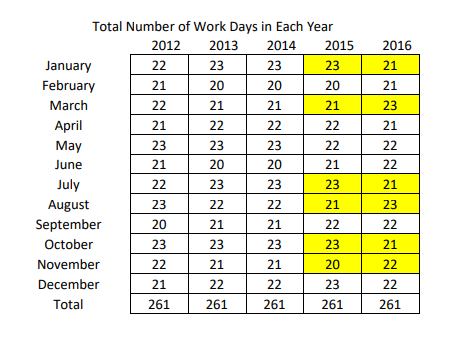

The methodology of the Calendar Month is the first day of each month through the last day of each month: January, March, May, July, August, October and December have 31 days, April, June, September, and November have 30 days, and February has either 28 or 29 days. This may seem simple enough, but the issue is how to allocate the monthly sales and expenses out to each of the days of the month. Most companies using the Calendar Month methodology use the 5-day work week as the basis for allocating revenue and expenses over the 7-day week. This methodology is typically used in smaller companies with the thought being that employees work five days a week and get paid for five days a week, and, therefore, they should record the revenue and expense over these five days. This may sound simple enough, but, as we will see there are some nuances in planning for the year over year changes in the number of days in each month. In the chart below, you can see that in years 2015 and 2016, the difference between the months of January, March, July, August, October, and November are two days versus the prior year, a 10% difference, so when doing a budget for the next fiscal year you would need to adjust the monthly sales and expenses accordingly. The good news in using the Calendar Year Methodology for your fiscal year is that all of the major Holidays, except Easter fall in the same month each year.

The Chart below shows the Number of work days in each calendar year.

The 13 Period or 52 Week Calendar is typically used by larger manufacturing companies and large retail establishments, which operate seven days a week. The 13 Period or 52 Week Calendar still has the Easter issue, but it also has one Christmas falling in the 53rd week. A benefit of using the 13 Period or 52 Week calendar is that you have a good record of the true daily sales activity for each week. This will allow you to identify the high sales volume or holiday week sales and move these weeks around when you are creating the sales budget for the next fiscal year. Since the 13 Period Calendar is consistent throughout the year, you don’t have to spend a lot of time analyzing the number of days in each month which occurs in the Calendar Month methodology.

At Cogent Analytics, we never stop looking for ways to improve your business and neither should you. So, check out some of our other posts for helpful business information: