Baking A Million Cupcakes Won’t Make You a Millionaire, But Understanding Your Cost of Goods Sold Will

It is natural to wonder about the cost of doing business with products we see stocked on the shelf every day. The famed “entrepreneurial curse” strikes when I least expect it, especially when I go out to eat. A $25 steak tastes the same if made at home for much less.

As business owners, it is imperative that we know the costs associated with creating our product in detail. We must understand every component of our product:

- The direct labor costs

- The overhead costs of materials used to create it

- The operational costs of being in business

- And foremost, the cost of profit that we will expect

This practice ensures that our pricing is right on the money.

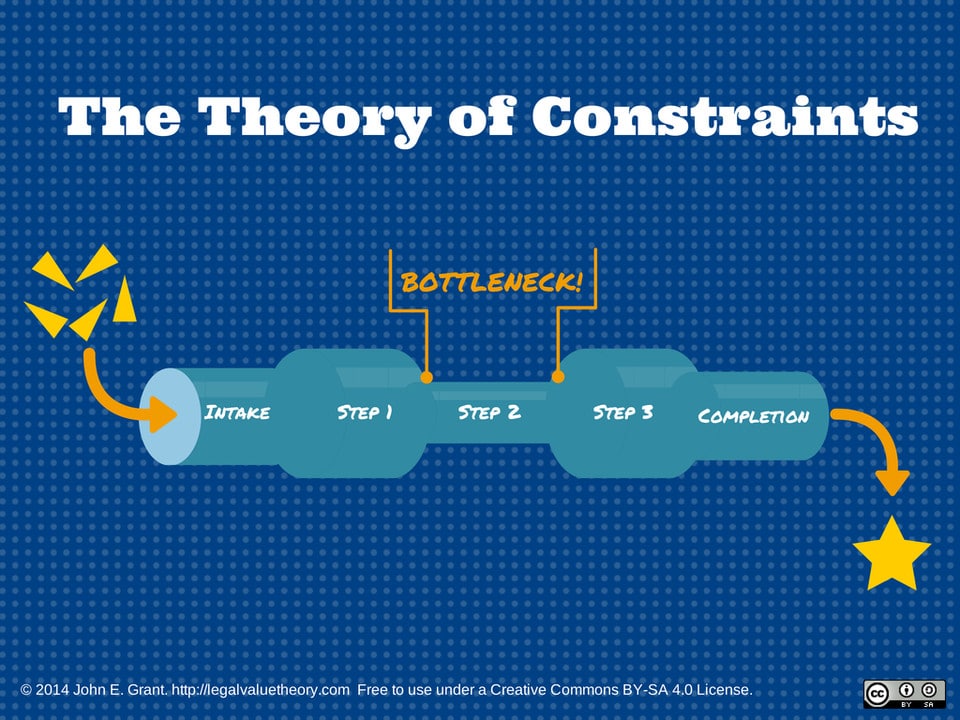

I have found, however, that many owners are unfamiliar with their pricing as it relates to their costs. Some argue that they know for sure that their customers will only pay a specific price, or that there are so many moving parts that pricing is inevitably futile.

When I received this feedback, I realized the owner had spent years figuring out what was essential for their business’s profitability and had been unsuccessful.

Here’s the deal: most profitable small businesses are not sheer luck; instead, they are born out of concrete data and an understanding of their costs.

Cost Optimization: Setting the Stage

A local bakery I frequented had been in business for twelve years. On the surface, this business seemed to be successful. They had a large following on social media and seemed to be busy during their open hours. Unfortunately, the owner worked six days a week in the bakery and spent much of her time at home working on “business owner” tasks. She could not turn enough of a profit to hire mid-level leaders to assist her in running it.

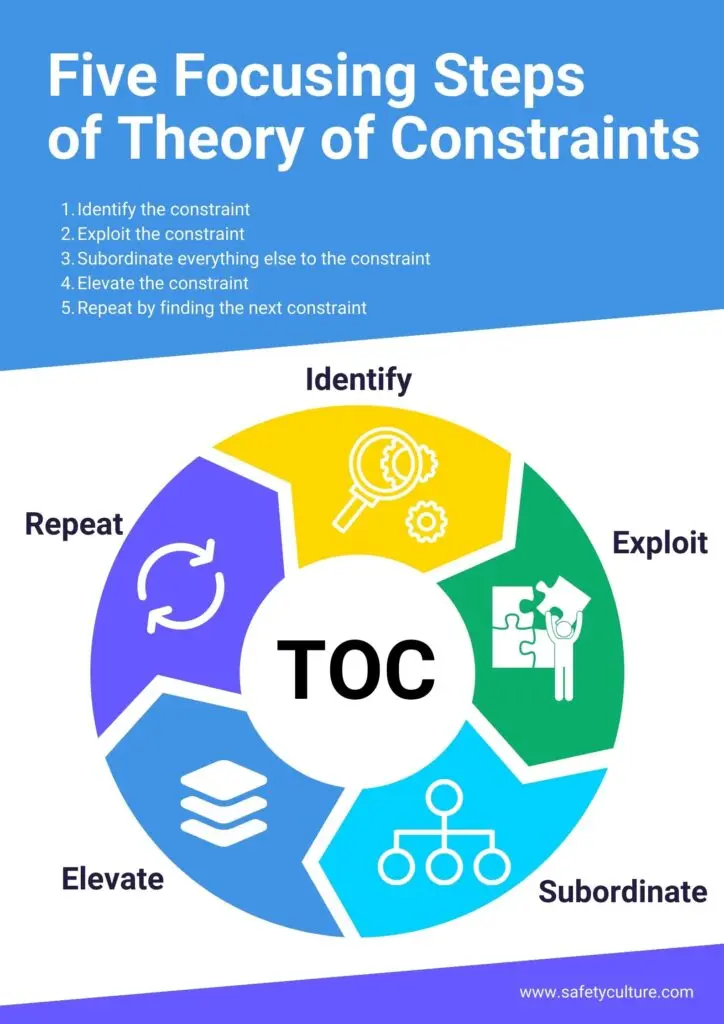

To discover the problem, I asked the owner what her most popular product was. Cupcakes were the top-selling product, but the owner had no idea how much it actually cost the business to make and sell them.

Cost Analysis Example

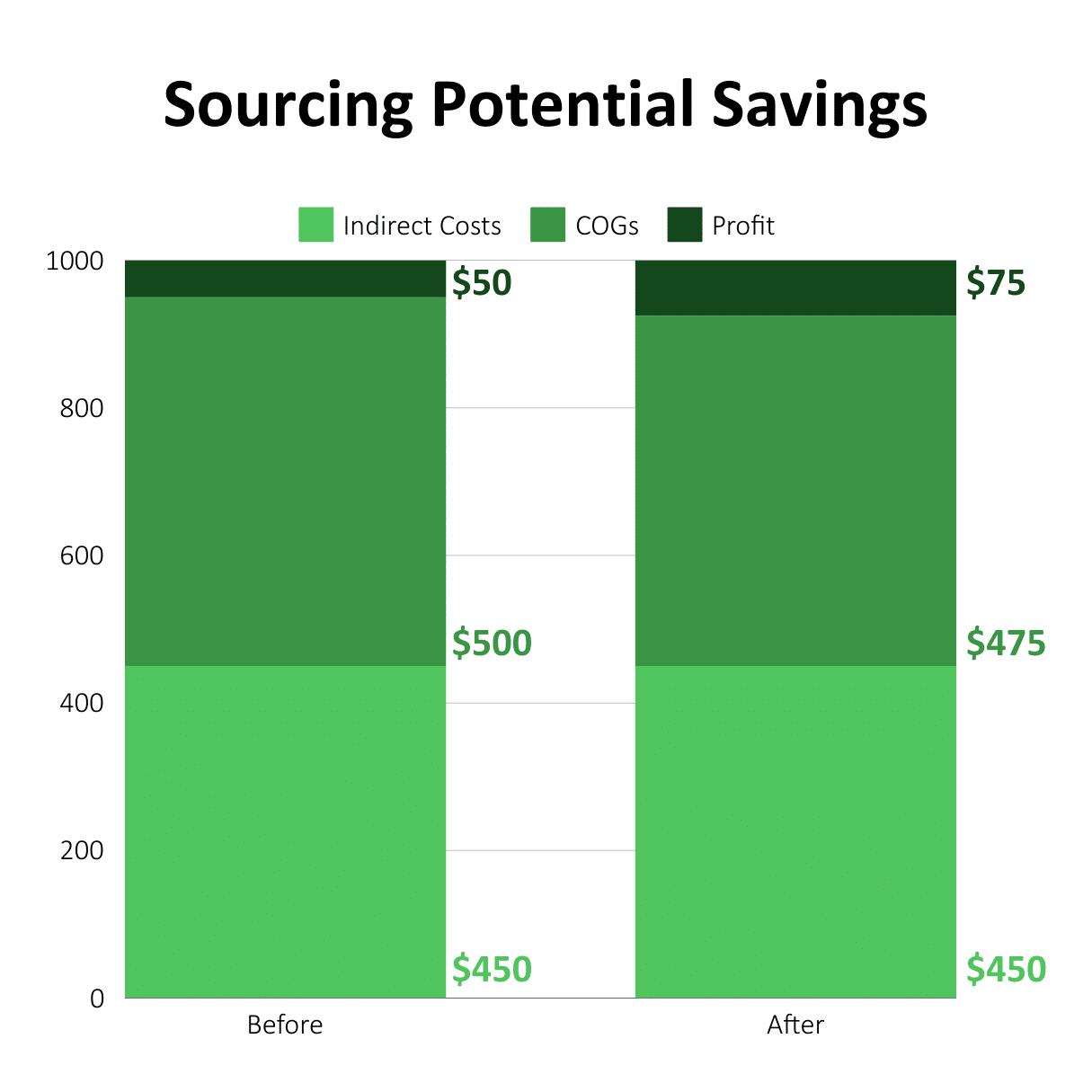

If the main product (the cupcakes) had been making her profit, then there’s no issue. Unfortunately, that was not the case. Her cupcakes broke even, and some of her secondary products lost money. The least advertised products were the ones keeping the business alive. We found all this out by investing the time to understand her product’s cost.

For this example, we need to calculate the cost of the ingredients that go into the cupcakes and the amount of ingredients needed to bake each individual cupcake. Sugar costs the bakery $9.89 for 23 cups, and our cupcake recipe calls for 2 cups. Thus, we are spending $0.86 for the sugar in the cupcakes, or $0.43 per cup. Our recipe makes a total of 24 cupcakes, which gives us a total sugar cost of $0.04 a cupcake.

After completing the same exercise for all the ingredients in the recipe, we found that the total ingredient cost for each cupcake was $1.10. We also need to consider:

- The cost of labor to produce a cupcake

- The error rate of the product

- And the overhead rate of fixed costs

In this case, our product cost before overhead was $2.47, which was previously unknown to the owner. The bakery was selling each cupcake for $2.50.

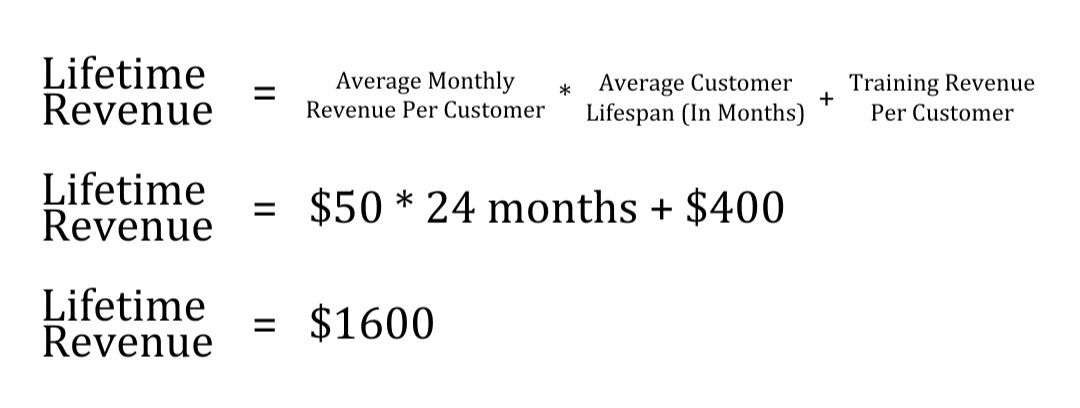

This gap in cost meant that the bakery owner could sell a million cupcakes and only have $30,000 left over for rent, equipment, utilities, and a fancy baker hat. (Admittedly, I did purchase one such hat for myself when working with this client.) Now that we have the details of the business costs associated with baking the cupcakes, we can begin to scrutinize our cupcake costs.

Cost of the Cupcakes

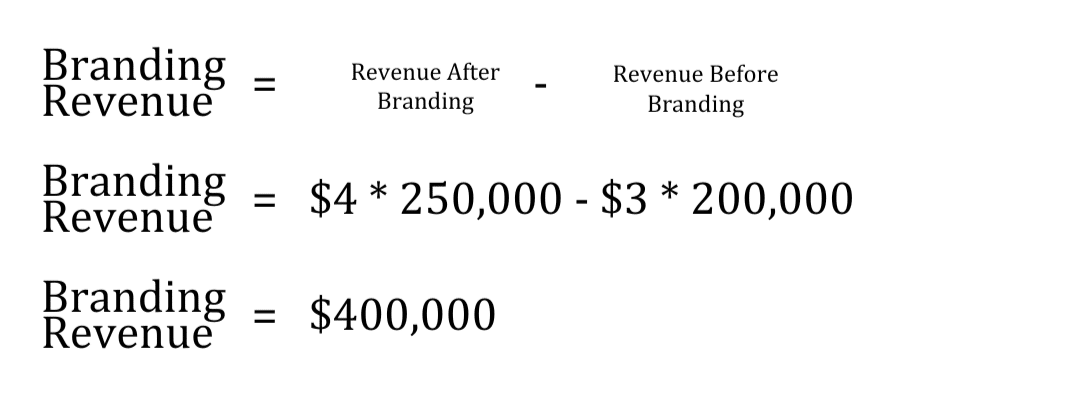

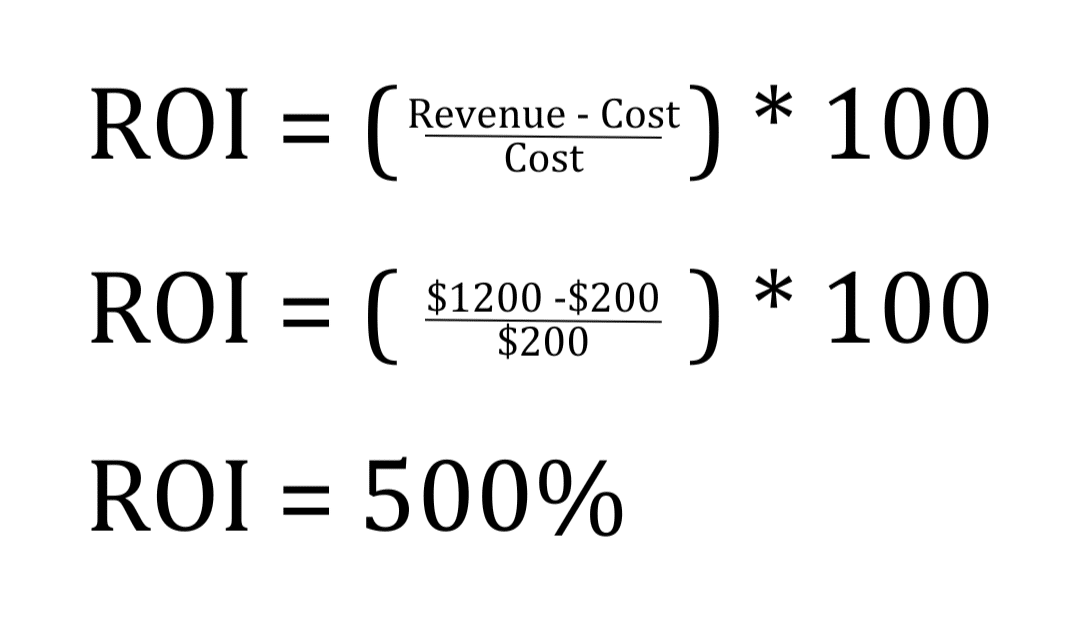

We conducted a price elasticity check by raising the price to $3.50 to see if it would affect sales. It did not. That takes the profit from $0.03 to $1.03 per cupcake. This change was a significant improvement, considering that this bakery also sold bulk cupcakes at $1.75 each based on what the owner deemed a reasonable price. This “reasonable price” came before the known costs. As we now know, that pricing would cause the business to lose $0.72 per cupcake.

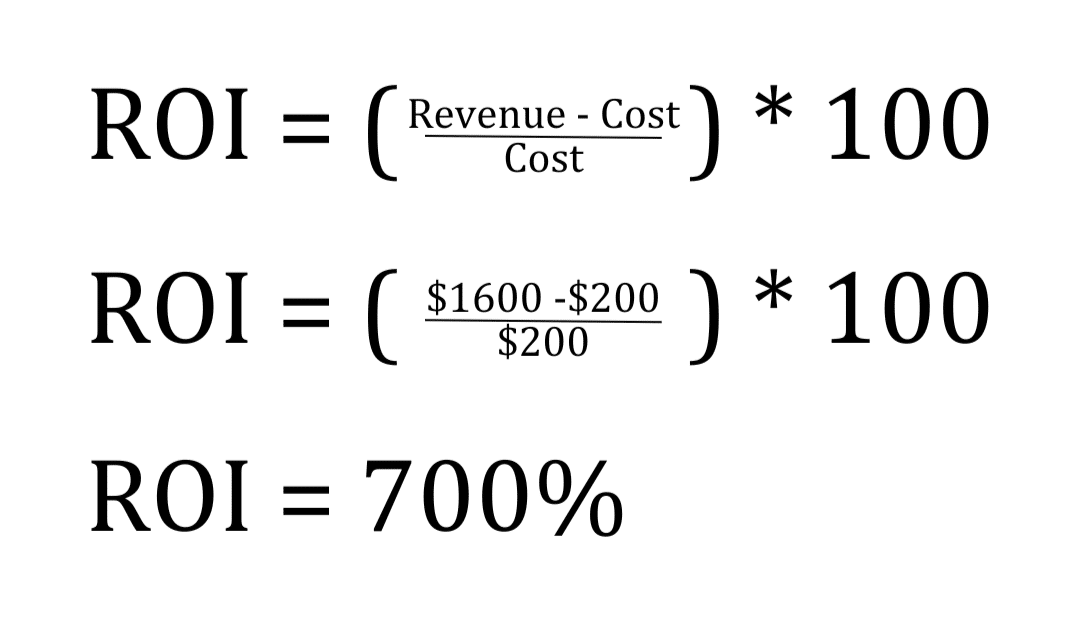

Once we felt secure in the pricing, we went on to see what ingredients drove the cost up the most. Some ingredients were available to order by the pallet and could be used in time to remain fresh. Discovering this brought our cupcake price down from $2.47 to $1.96, saving us $0.51 a cupcake.

A Cupcake Cost Savings Conclusion

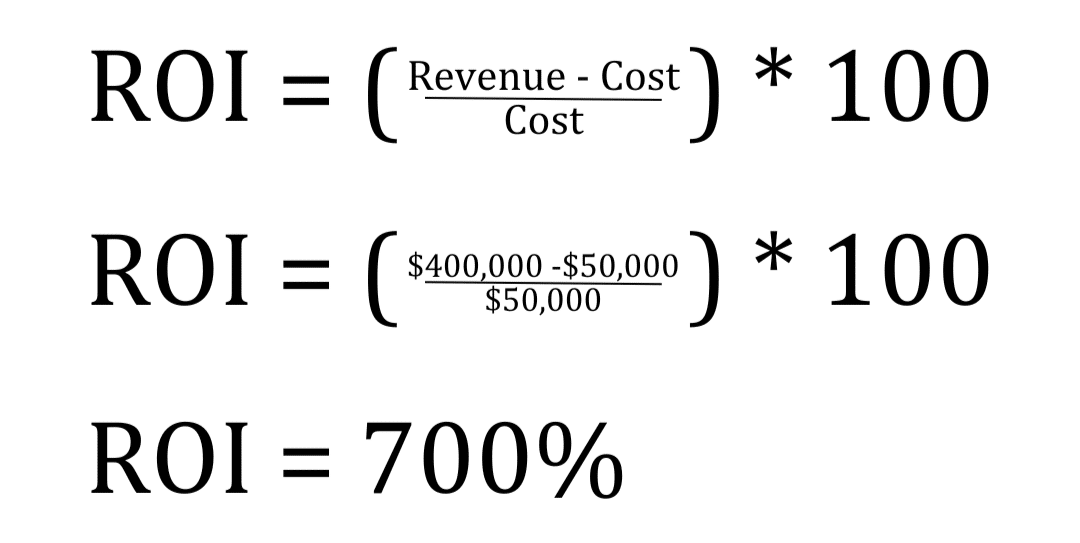

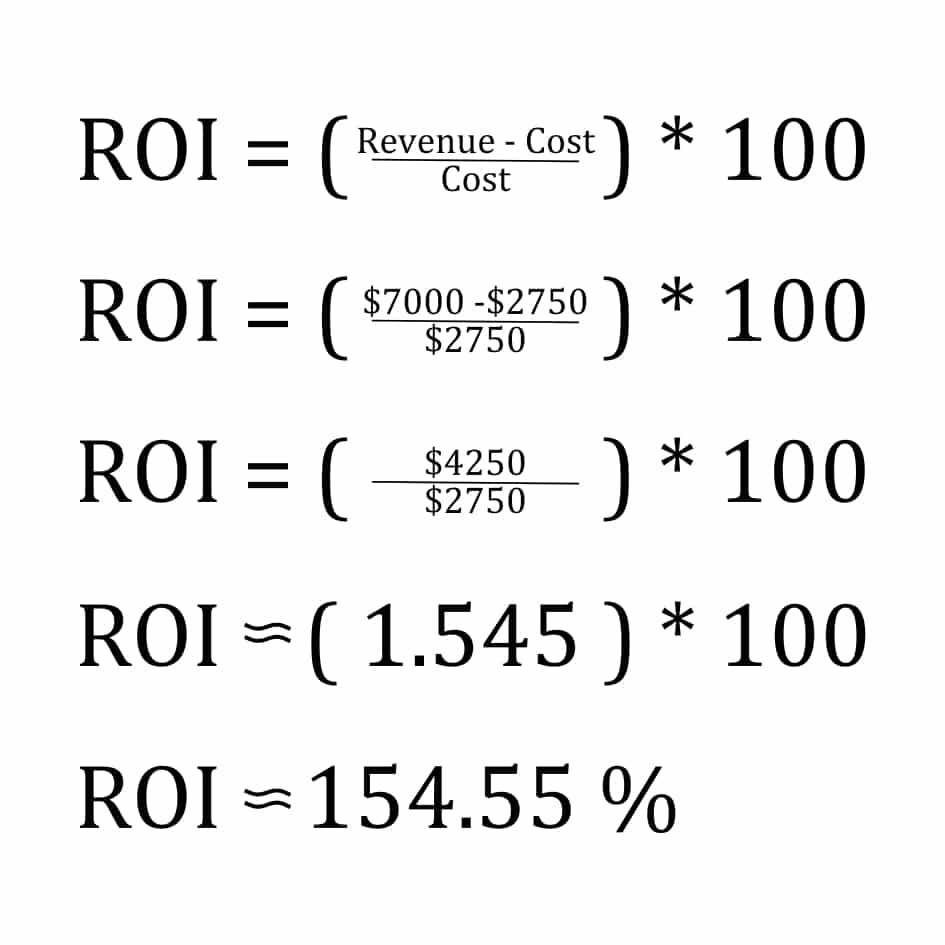

After understanding all these pricing factors, selling a million cupcakes would yield a profit of $1,540,000 to pay overhead and invest in the business. Understanding your pricing structure drives profitability for your small business, allowing for more opportunities to thrive!